Publicité

Les langues disponibles

Les langues disponibles

Liens rapides

INSTRUCTIONS

PRINTED IN CHINA / IMPRIMÉ EN CHINE

MODE D'EMPLOI

Calculation Example/

Exemples de calculs

CALCULATION / CALCULS

OPERATION / OPÉRATIONS DISPLAY / AFFICHAGE

Mixed / Mixtes

BUSINESS MEMORY

140–35+22=127

140

35

2x 2 3=6

2

2

CI

3

C

–7x9 9 =–63

7

99

+ -

(2+4)÷3x8.1=16.2

2

4

3

8

1

Constant / Constantes

2+3=5

2

3

4+3=7

4

1–2=–1

1

2

2–2=0

2

2x3=6

2

3

2x4=8

4

6÷3=2

6

3

9÷3=3

9

Power, Fraction /

Puissance, fractions

4

3

=81

3

1/5=0.2

5

1/(2x3+4)=0.1

2

3

4

Square Root / Racine carrée

3 = 1.73205080756

3

Add Mode / Mode addition

$14.90+$0.35-$1.45=13.80

1490

35

Floating Calculation /

Calculs flottants

8÷3x3.7+9=18.8666666666 8

3

3

Reciprocal Calculation /

Calculs réciproques

1/7=0.14285714285

7

Percentage / Pourcentages

12

1200x

=144

1200

12

100

15

1200x

=180

15

100

1200+(1200x20%)=1,440

1200

20

1200–(1200x20%)=960

1200

20

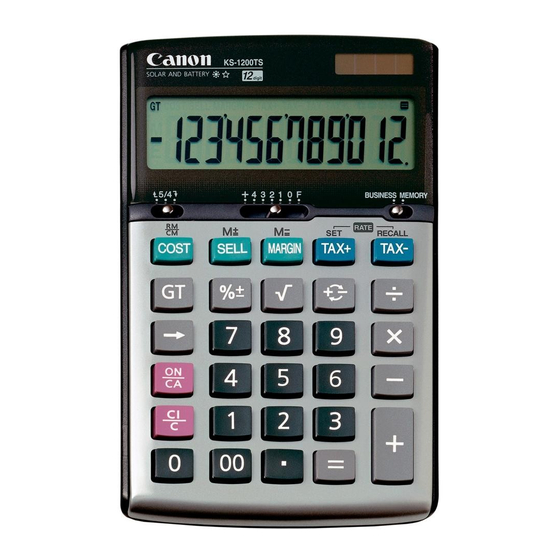

KS-1200TS

Memory / Mémoire

3x4= 12

PUB E-IM-2192

–)

6÷0.2= 30

+)

Grand total / Total général

30x40=1,200

50x60=3,000

+)

25x30= 750

(

0.)

+)

235x35=8,225

22

(

127.00)

(

6.00)

(

–63.00)

Tax Rate Set / Établissement du taux de taxe

Tax Rate / Taux de taxe = 5%

(

16.20)

Recall Tax Rate / Rappel du taux de taxe

Add the Tax Amount / Addition de taxe

(

5.00)

Price $2,000 without tax /

Price $2,000 without tax

Prix 2 000 $ sans taxe

(

7.00)

Selling price with tax? ($2,100)

Selling price with tax? ($2,100) /

Prix de vente avec taxe ? (2 100 $)

(

–1.00)

Tax amount? = ($100) /

Tax amount? = ($100)

Montant de la taxe ? = (100 $)

(

0.00)

Deduct Tax Amount / Soustraction de taxe

(

6.00)

Selling price $3,150 with tax /

Selling price $3,150 with tax

Prix de vente 3 150 $ avec taxe

(

8.00)

Price without tax ? ($3,000) /

Price without tax ? ($3,000)

Prix sans taxe ? (3 000 $)

(

2.00)

Tax amount? = ($150) /

Tax amount? = ($150)

Montant de la taxe ? = (150 $)

(

3.00)

Cost-Sell-Margin Calculation /

Calcul des coûts-ventes-marges

Calculating Cost / Calcul du coût

(

81.00)

Selling Price : $1,500 /

Selling Price / Prix de vente : $1,500

Prix de vente : 1 500 $

(

0.20)

Profit Margin : 30% /

Profit Margin / Ratio de marge bénéficiaire : 30%

Ratio de marge bénéficiaire : 30 %

(

0.10)

Cost = ? ($1,050) /

Cost / Coût =? ($1,050)

Coût = ? (1 050 $)

Calculating Selling Price / Calcul du prix de vente

Cost : $2,000 /

Cost / Coût : $2,000

Coût : 2 000 $

Profit Margin : 20% /

( 1.73205080756)

Profit Margin / Ratio de marge bénéficiaire : 20%

Ratio de marge bénéficiaire : 20 %

Selling Price = ? ($2,500) /

Selling Price / Prix de vente : $2,500

Prix de vente = ? (2 500 $)

Calculating Profit Margin / Calcul du ratio de marge bénéficiaire

Cost : $1,500 /

Cost / Coût : $1,500

145

(

13.80)

Coût : 1 500 $

Selling Price : $2,000 /

Selling Price / Prix de vente : $2,000

Prix de vente : 2 000 $

Profit Margin = ? (25%) /

Profit Margin / Ratio de marge bénéficiaire = ? (25%)

Ratio de marge bénéficiaire = ? (25 %)

Overflow / Dépassement

7

9

( 18.8666666666)

de capacité

1) 123456789x78900

=9740740652100

(ERROR / ERREUR)

(

0.143)

2) 999999999999

123

(Add to Memory / Ajout à la mémoire)

(

144.00)

(

180.00)

(

1'440.00)

3) 6÷0=0

(

960.00)

(ERROR / ERREUR)

BUSINESS MEMORY

(

3

4

(

M

6

2

(

M

–18

(

M

200

200

(

M

182

(

M

(Recall memory / Rappel mémoire)

(

(Clear memory / Effacement mémoire)

(

GT

30

40

(

GT

50

60

(

GT

25

30

(

GT

4,950

(

GT

GT

235

35

(

GT

13,175

(

GT

(Grand Total / Total général)

(

GT

(Clear Grand Total / Effacement du total général)

TAX%

SET

SET

5

(

TAX%

RECALL

(

2000

(

(

TAX+

(

3150

(

(

TAX–

(

BUSINESS MEMORY

SELL

1500

(

COST

30

(

COST

2000

(

SELL

20

(

COST

1500

(

MARGIN%

2000

(

BUSINESS MEMORY

123456789

78900

( 9.74074065210)

E

( 9.74074065210)

(Add to Memory /

M

999999999999

(

999'999'999'999.)

Ajout à la mémoire)

123

(

M

1.00000000012)

E

(

M

1.00000000012)

(

6

0

(

E

(

0.)

POWER SUPPLY

12.00)

This calculator comes with a dual power source. The duration of Lithium

battery depends entirely on individual usage.

30.00)

–18.00)

Electromagnetic interference or electrostatic discharge may cause the

display to malfunction or the contents of the memory to be lost or

200.00)

altered. Should this occur, use the tip of a ball point pen

182.00)

(or similar sharp object) to press the [RESET] button

182.00)

on the back of the calculator. After resetting, be sure

to set the tax rate again.

0.)

1'200.00)

AUTOMATIC POWER-OFF FUNCTION

3'000.00)

When the power is turned "ON" and none of the keys are pressed for

more than 8 minutes, the calculator turns off automatically to save power.

750.00)

Press

key to re-start the calculator. "0" will appear in the display.

4'950.00)

8'225.00)

DECIMAL POINT SELECTOR SWITCH

13'175.00)

: Used for designating the decimal point position

(+ 4 3 2 1 0 F) for calculated results.

13'175.00)

+ (Add-Mode) : Addition and subtraction functions are

performed with an automatic 2-digit decimal. It is convenient

5.)

for currency calculations.

5.)

F (Floating Decimal Point) : All effective numbers up to 12

digits are printed or display.

2'000.)

ROUNDING SWITCH

2'100.00)

: Used for round-up [

TAX

100.00)

the pre-selected decimal digits in the result.

COST-SELL-MARGIN CALCULATION

3'150.)

Set the

BUSINESS MEMORY

switch to "BUSINESS" to perform cost, sell and profit

3'000.00)

margin calculation.

TAX

150.00)

– Used for calculating the cost, selling price and profit

margin amount. Enter the value of any 2 items to obtain the

balance value item. (e.g. enter the value of the cost and the selling

price to obtain the profit margin.)

1'500.)

1'050.00)

TAX CALCULATION

Store the Tax Rate – Press

SET

figure, then press

RECALL

Recall the Tax Rate – Press

2'000.)

rate.

2'500.00)

Add Tax Key – Used for adding the tax amount to the displayed

figure.

Deduct Tax Key – Used for deducting the tax amount from the

1'500.)

displayed figure.

25.00)

OVERFLOW FUNCTION

In the following cases, when "E" is display, the keyboard is electronically

locked, and further operation is impossible. Press

overflow. The overflow function occurs when:

1) The result or the memory content exceeds 12 digits to the left of the

decimal point.

2) Dividing by "0".

SPECIFICATION

Power Source: Solar cell and Lithium battery (CR2032 x 1)

Usable Temperature : 0˚C to 40˚C (32˚F to 104˚F)

0.)

Dimensions: 107mm (W) x 172mm (L) x 24mm (H) /

4-7/32" (W) x 6-25/32" (L) x 61/64" (H)

0.)

Weight: 183g (6.46 oz)

0.)

(Subject to change without notice)

ENGLISH

], round-off [5/4], or round-down [

] to

SET

and enter the tax rate

SET

to store.

RECALL

to recall the current tax

to clear the

Publicité

Sommaire des Matières pour Canon KS-1200TS

- Page 1 ENGLISH KS-1200TS BUSINESS MEMORY Memory / Mémoire POWER SUPPLY INSTRUCTIONS PRINTED IN CHINA / IMPRIMÉ EN CHINE 3x4= 12 12.00) This calculator comes with a dual power source. The duration of Lithium MODE D’EMPLOI PUB E-IM-2192 battery depends entirely on individual usage.

- Page 2 FRANÇAIS ALIMENTATION Cette calculatrice est dotée d’une double source d’alimentation. La durée d’une pile au lithium dépend entièrement de l’utilisation individuelle. Une interférence électromagnétique ou une décharge électrostatique peuvent causer des erreurs d’affichage ainsi que la perte ou la modification du contenu de la mémoire.